The post Introducing Native OTP Assist appeared first on PayU Blog.

]]>What Can You Do with the OTP Assist?

Here’s how Native OTP Assist improves customer experience on your mobile app.

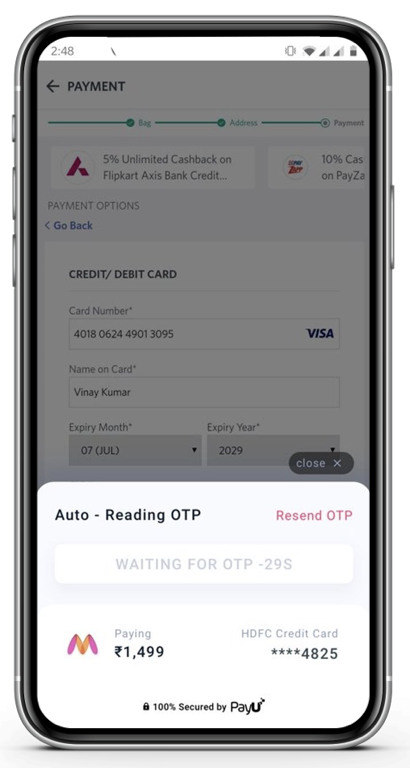

In-App and Seamless Experience

In the age of online payment, your customer expects seamless transactions with minimum user interaction. With this SDK, you can allow your application to read and submit the OTP automatically.

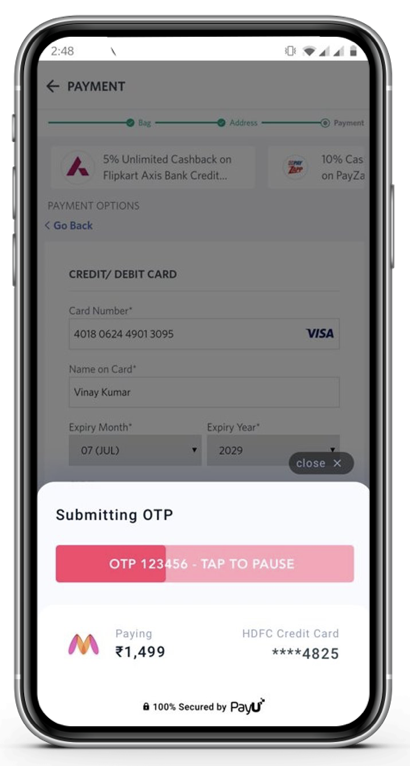

The customer can complete the transaction on the merchant’s page. There are many UI customization options to match your app’s theme.

Reading OTP

OTP Submission

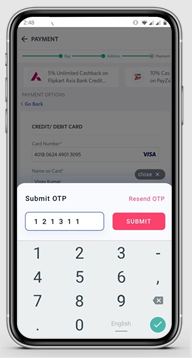

Review and Submit Manually

If the user prefers to submit the OTP manually, the SDK will automatically allow the app to read and display it on the screen. The OTP can be reviewed and submitted manually.

OTP Review & Manual Submission

Supported by Top Banks and Cards Providers

We have already added top banks and card providers for card payments, and it is growing every day. To get more details about the supported list, please reach out to the mobile integration team at mobile.integration@payu.in.

Everything You Need to Get Started

Head over to our developer docs – Android iOS and integrate Native OTP Assist SDK now!

Additionally, you can look at a variety of payments SDKs that PayU offers for a seamless payments experience – Android, iOS, and React Native.

For any integration-related support, please reach out to your key account manager or write to us at mobile.integration@payu.in.

The post Introducing Native OTP Assist appeared first on PayU Blog.

]]>The post Join The Payment Revolution- Create and Use Your UPI Payments ID appeared first on PayU Blog.

]]>In 2016, the National Payments Corporation of India (NPCI) developed and introduced a real-time digital payments system under the Digital India campaign. Named the Unified Payments Interface (UPI), it’s an online payment system that instantly transfers the funds between two bank accounts in real-time. It serves as a faceless & cardless payments service.

Within just the first 37 months of its launch in 2016, this mobile-only payment system helped transact a total of ₹17.29 lakh crore (US$ 230 billion) in India. In fact, in 2020, India became the world’s largest real-time payment market with 25.5 billion annual transactions, leaving China and the United States behind.

This popularity can be attributed to the simple interface and seamless transactions of UPI applications, which makes this digital payments platform easy to use for everyone. With features such as instant cashback, referral bonuses, lucky draws, and other lucrative rewards on transactions, more & more people are shifting to UPI payments instead of using cash or cards.

So, if you feel like you have been missing out on the benefits of UPI payments, scroll down and find out how you can avail these benefits and more by creating your UPI ID.

But first,

What Is A UPI ID or UPI Payments ID?

It is an online payment system that enables you to virtually transfer money from one bank to another. An Aadhaar Enabled Payment System (AEPS).

Traditionally, if you transfer money through a bank, you will need details such as the bank name, bank account number, branch address, and IFSC of the beneficiary. These details will have to be entered every time you want to transfer money. A UPI ID or a virtual payment address (VPA) eliminates this hassle.

As the name suggests, your virtual payment address is a unique ID that enables you to send or receive money through UPI from/to your bank account without sharing each other’s account numbers or other details.

Linked with a UPI-enabled Bank, your UPI ID can be created on any UPI payment application like BHIM and others.

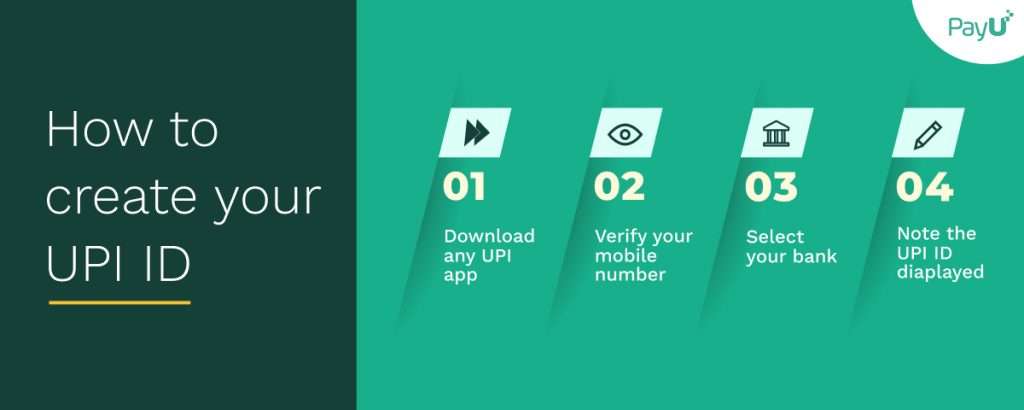

How To Create Your UPI Payments ID or VPA?

There are many Unified Payments Interface payments apps available in the market. However, the steps to create your UPI ID are almost the same across all these apps. Irrespective of which app you use, you will first have to register your bank on the app to create your UPI ID. You can do this through the following steps:

- Download your desired UPI digital payments app, which will prompt you to set a four-digit app code upon opening.

- After this, the app will ask you to verify your mobile number. If you have a dual sim, select the number which is registered with your bank. The app will then verify this number on its own through an OTP.

- After this verification, the app will ask you to select your bank and will automatically receive the required details such as bank name, the IFSC code, and account number. If you have more than one account added to the same mobile number, you can select your desired account.

- Finally, the app will display your UPI ID.

- And voila! You have successfully created your UPI ID or VPA!

Registering for UPI ID through the *99# service

Alternatively, you can also register for a UPI ID through the *99# service. Here’s how:

- Dial ”*99#” on your phone and select your preferred language.

- Enter your bank’s name or the first four digits of your IFSC code.

- Choose your bank account and enter the last six digits and the expiry date of your debit card.

- Enter and set your UPI pin or MPin.

- Confirm your UPI pin or MPin, and there you go. You have your UPI ID!

How To Locate Your UPI Payments ID In A Bank Application?

You can find your UPI ID or VPA within your UPI app.

We have discussed two of the most commonly used apps. The process for all the apps might be almost similar with little to no differences.

For Google Pay Users:

- Open the Google Pay app and click on your photo in the top right corner.

- Click on Bank Account.

- Select the bank account linked with the UPI ID.

- You will find the associated UPI ID under the name “UPI IDs” with its QR Code.

For BHIM App Users:

- Log in with your app password.

- Click on “Profile” from the drop-down menu. You’ll find your UPI ID with your QR Code

How Can You Change Your UPI Payments ID?

If you are not satisfied with your UPI address, you have the option of changing it. Here’s how:

For BHIM App Users:

- Open the BHIM app and go to your profile.

- Click on Settings.

- You will see the option to edit your UPI ID.

- After making the necessary changes to your ID, click Confirm.

For Google Pay Users:

- Go to Google Pay and click on your profile photo.

- Click on “Bank accounts” in “Payment Methods” and select the bank account whose UPI ID you want to edit.

- Tap the UPI ID associated with your favoured bank account and click on Manage UPI IDs.

- Click ‘+’ icon next to the UPI ID you’d like to have.

Why Should You Use UPI Payments & Its Benefits

Here are some features of UPI payments that make them one of the best payment options available today:

- Single click payment.

- Instant money transfer through any mobile device 24×7 for all 365 days.

- No minimum transaction limit.

- No transaction charges.

- One mobile application for managing various bank accounts.

- No need to enter multiple bank details for transactions.

- Resolve complaints and queries through the mobile app.

- Option to share the receipt of transactions and bills.

- Enhanced reliability & security since the RBI regulates it.

- Attractive rewards on transactions on selected apps*.

Conclusion

Today, the UPI payments system is leading the non-cash systems in India ahead of net banking and debit & credit cards. These are being used by individuals, merchants, retailers, and manufacturers across the country. In fact, as of May 2021, the platform has 100 million monthly active users in India.

With this digital payments revolution, businesses are finding it much more convenient to send and accept payments in real-time, saving them the hassle of going to banks or making cash payments while also making the process easier for their customers.

With 100+ payment options available on PayU, including UPIs, cards, wallets, net banking, Buy Now-Pay Later(BNPL) systems, let your customers choose from multiple payment options, anywhere, anytime!

The post Join The Payment Revolution- Create and Use Your UPI Payments ID appeared first on PayU Blog.

]]>