The post Check Out Our New Campaign #TimeIsNow appeared first on PayU Blog.

]]>We came up with relatable stories of three business owners, Anu, Kamal, and Saad, ready to take the next step in their business. Each has their doubts and is unsure if #TimeIsNow to grow. This campaign shows how PayU powers their businesses to collect and track multiple payments worldwide, automate vendor payouts, and process recurring payments seamlessly.

Tap on the video below to find out how!

Here are the stories of Anu, Kamal & Saad!

Anu is an entrepreneur who owns Upsyche, an upcycled clothing line. She was getting orders from multiple sources but something was stopping her. She just automated the way she collects and tracks payments from multiple sources with PayU. What happened next is for you to see!

Kamal owns a healthcare company, Medlo which is an aggregator of medical consultation & medicine delivery. He wanted to take go PAN India but something was stopping him. He onboarded new vendors across India with PayU. What happened next will amaze you!

Saad is an entrepreneur who owns Clickr, a SaaS company. He wanted to change his business model but something was stopping him. He took the next step to adopt a new business model with PayU. Tap on the video to find out what happened next!

But do you know what was common between them?

They all believed that #TimeIsNow and took the next step.

Did Anu, Kamal & Saad’s journey inspire you to take your leap of faith? Let’s do it together!

The post Check Out Our New Campaign #TimeIsNow appeared first on PayU Blog.

]]>The post Introducing Native OTP Assist appeared first on PayU Blog.

]]>What Can You Do with the OTP Assist?

Here’s how Native OTP Assist improves customer experience on your mobile app.

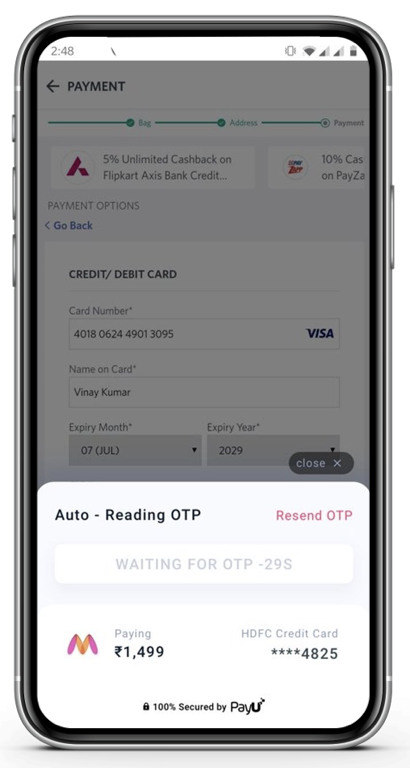

In-App and Seamless Experience

In the age of online payment, your customer expects seamless transactions with minimum user interaction. With this SDK, you can allow your application to read and submit the OTP automatically.

The customer can complete the transaction on the merchant’s page. There are many UI customization options to match your app’s theme.

Reading OTP

OTP Submission

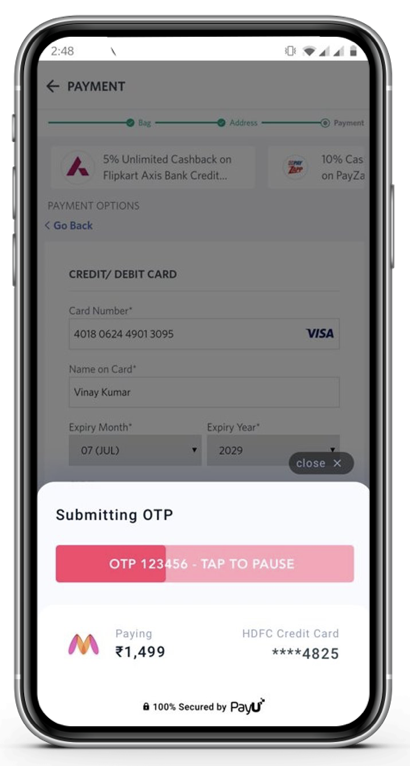

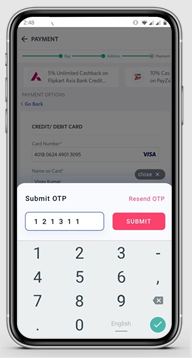

Review and Submit Manually

If the user prefers to submit the OTP manually, the SDK will automatically allow the app to read and display it on the screen. The OTP can be reviewed and submitted manually.

OTP Review & Manual Submission

Supported by Top Banks and Cards Providers

We have already added top banks and card providers for card payments, and it is growing every day. To get more details about the supported list, please reach out to the mobile integration team at mobile.integration@payu.in.

Everything You Need to Get Started

Head over to our developer docs – Android iOS and integrate Native OTP Assist SDK now!

Additionally, you can look at a variety of payments SDKs that PayU offers for a seamless payments experience – Android, iOS, and React Native.

For any integration-related support, please reach out to your key account manager or write to us at mobile.integration@payu.in.

The post Introducing Native OTP Assist appeared first on PayU Blog.

]]>The post 9 Key Considerations Before Choosing A Payment Gateway appeared first on PayU Blog.

]]>Still, it might be challenging to make the right and trustworthy choice at times. Apart from checking the Payment Gateway charges and comparing them, there are several other factors to consider while choosing a Payment Gateway for websites.

While selecting a Payment Gateway, you must examine the technological and financial aspects of the chosen solution, the convenience for your consumers, and the security of that gateway.

Why is a Payment Gateway Essential?

A Payment Gateway refers to a merchant service to authorise credit card transactions. The acquired card details of a customer are sent to the Payment Gateway for validation. The Payment Gateway then transfers the details to the respective bank (that issued the card) and verifies it. Finally, the card provider responds with the details, including if the required amount is available for credit and if the details provided by the customers are accurate. If every detail favours the transaction, it is approved by the Payment Gateway, and the transaction completes. Many Payment Gateway APIs also include enhanced security features like fraud detection.

Top 9 Things to Consider while Choosing a Payment Gateway:

Here are several points that must consider before choosing the Payment Gateway to integrate with your website, as follows:

Modern or traditional?

It would help decide which Payment Gateway API you are looking for, modern or traditional. Here is a brief differentiation of both:

| Modern | Traditional |

| Modern Payment Gateways let you use their services without needing a business account. | Traditional Payment Gateways necessitate the creation of a direct business account. |

| Modern Payment Gateways are generally quicker to set up, but they come with higher fees and may take your clients offsite to complete a payment, thereby lowering conversions. | Setting them up is time-consuming, but they have a lower fee. |

Standards for encryption:

The encryption standard is the next thing to consider and must be prioritised. A Payment Gateway handles the financial details of the customers, and even a single security breach can cause massive destruction to their economic status and your company’s overall reputation.

Therefore, you must ensure that the Payment Gateway integration that you choose has highly effective encryption standards set in place.

For the beginning, you can choose a Payment Gateway API that offers encryption standards like tokenisation (to hide the card details completely).

Choosing a secure Payment Gateway eradicates several risks and thus ensures reduced processing charges. It also helps to eliminate the chances of human error and improve reporting visibility.

Compatibility:

You never know which device or operating system your customers are using. Thus, it is essential that whichever services you offer are compatible with many devices, including the benefit of access to a Payment Gateway. This will eventually help enhance the overall user base due to the ease of payments

Speed:

Various Payment Gateways have varied processing times. Still, there is always a need for a processor to obtain and validate the card details in just a few seconds whenever a customer initiates a transaction. Thus, you are also advised to consider the time required by these Payment Gateways while deciding to ensure that you quickly receive your payments and never have to wait much.

Features for reporting:

As per the industry and business you deal with, you need a Payment Gateway with extensive reporting capabilities, thus focusing on this consideration. The Payment Gateway must also provide the feature to let you go through all the transaction activities to help you analyse and complete an overview of the received payments. You might want to check your commissions at any instance, and then the various report formats must be available with the Payment Gateways.

Other security aspects include fraud detection:

Fraud detection is a primary concern you must check for while selecting a Payment Gateway API. Ensure that the chosen Payment Gateway for the website can detect any suspicious behaviours before completing any transaction. This is beneficial for your company as well as for your customers.

Capabilities for billing:

Having a built-in billing feature is another feature that may help your business, and thus you are suggested to choose a Payment Gateway assuring the same. This capability will ensure that the entire payment procedure gets more straightforward, and you no longer have to depend on any third-party services

User interface and usability:

At least once every few days, you will need to connect with your Payment Gateway API for checking transactions, fees, and several high-value data. When such a need arrives, you will surely expect a satisfactory experience. This is why having a Payment Gateway that is easy to access, user-friendly, and straightforward is essential. However, to know which one is the best suited as per your expectations, it is advised to check a few services first and only make the final decision.

Fees and costs:

The final consideration while choosing a Payment Gateway has to be the applicable fees and costs. Based on the array of features provided, the price of the Payment Gateways might vary significantly. Some are available for free, while the others are for a few dollars or more. Your decision is dependent on your budget and how well you expect your organisation to function.

Conclusion:

There isn’t anything like a perfect product or service while considering anything, even during the consideration of the Payment Gateways. The different gateways are suitable for different people based on the use case, the demand, the budget, and other factors. The above-mentioned key considerations are the best suited to help you make the right decision while choosing a Payment Gateway.

To read more such valuable information, check out https://payu.in/

The post 9 Key Considerations Before Choosing A Payment Gateway appeared first on PayU Blog.

]]>The post Checkout For Bharat: An Effortless Way To Expand Your Business Reach Across India appeared first on PayU Blog.

]]>But scaling and growing a business in India isn’t easy at all. It is because India has a diverse population. If we go by the stats from the census report of 2011, out of 121 crores, over 100 crore people speak 30+ languages in nearly 1600 dialects. Hindi is a widely spoken language in India followed by English. It is also seen that around 43.63% of Indians speak Hindi as their first language. It is spoken in 50+ dialects. Rural parts of India are dominated by local languages and dialects. Leveraging the Digital India initiative, 9 out of every 10 users prefer to consume content in their native language only (Source: Google).

So, do you think relying only on English for business communications to customers in India is enough? Definitely not! That’s why PayU has launched a vernacular payment checkout solution – Checkout for Bharat. A customized solution for businesses like yours that will help you penetrate rural areas along with tier 2 and tier 3 cities. It will also help in breaking the language barrier between the customer and your business. Let’s find out how?

What is Checkout for Bharat?

It is a personalized payment solution for businesses like yours to offer vernacular checkout to customers in their native language. To start with, PayU is going live with Hindi language and in the upcoming months, Checkout for Bharat will be available in other native languages like Bengali, Marathi, Telugu, Tamil, Gujarati, and Kannada.

Users will always have the option to switch between the languages anytime they want. Their preferred language will be saved for the next time they come again to make payments. With Checkout for Bharat, the customers will have an option to choose one preferred language. Our advanced APIs will detect the preferred user’s language on the web or mobile and offer the checkout page in that language. Even, the error codes and pages will be rendered in their preferred languages only.

Is Checkout for Bharat the Right Fit for Your Business?

Checkout for Bharat is beneficial for businesses:

- Having or aspiring to have a customer base which is largely rural, tier 2 and, tier 3 Indian population.

- Having their websites in vernacular languages and looking to build a checkout experience that enhances their customers’ payment experience.

Why Do You Need Checkout for Bharat?

Customers these days love a personalized solution that’s only built for them. Then, why should the checkout page be in English when you can offer it in their native language?

With Checkout for Bharat, PayU enables businesses:

- To provide an indigenous experience to their customers

- To reduce poor experience for native language speakers and customer drop-off rates significantly.

If you have a business presence in rural, tier 2, and tier 3 cities already or you are finding ways to tap into these geographies, Checkout for Bharat is the ideal solution for you!

What Makes Checkout for Bharat a Choice for All Businesses

Government Entities

The government entities such as railways, tax, and municipal corporations have to cater to customers from all parts of India. Giving a personalized checkout experience in their customers’ native languages would help them achieve enhanced customer satisfaction in their payment journey.

Insurance, Telecom, OTT and EdTech

Companies that fall into these categories usually have recurring billing cycles. Implementing PayU’s vernacular checkout experience for their customers would benefit them. They can easily tap into the audience in tier 2 and 3 cities of India including the rural segment.

Online Gaming Platforms

Online gaming platforms have a varied customer base from all parts of India. With Checkout for Bharat, growing a business would become quite simple. They can offer a better user experience and achieve high retention rates effortlessly.

E-commerce

Checkout for Bharat can do wonders for SMBs and e-commerce giants having heavy penetration in tier 2 and tier 3 cities. It can also help businesses planning to tap into these untapped geographies.

With a vernacular payment experience, they will get an edge over their competitors by offering a checkout experience in their customers’ preferred language. Establishing a better connect with their customers would become no big deal.

Conclusion

Going vernacular strikes the right chords in many ways. It is certainly a delight for any native language speaker/reader. So, capturing the regional nuances would open up new avenues for any business and enhance the chances to be with you.

So why wait, take the plunge right now and have an edge over your competitors right away!

The post Checkout For Bharat: An Effortless Way To Expand Your Business Reach Across India appeared first on PayU Blog.

]]>The post PayU Acquires Payment and Security Firm Wibmo for $70Mn appeared first on PayU Blog.

]]>Recently, we took the next step in this journey – well, a leap actually! We are glad to share with you that we have acquired California-based payment and security company Wibmo for $70 Million. And this strategic acquisition has taken our fintech investment total past the $500 million mark, putting us within the top five leading global fintech investors over the last two years.

We believe that constant technological advancements in the digital payments industry will help save a lot of time and effort for the users be it merchants or end customers.

Found in 1999, Wibmo helps over 20 nations with payment security and authentication, risk management and mobile payment solutions. They, like us, are committed to making digital payments frictionless through innovative products and services, supporting the Government’s vision of a Digital and Cashless India.

This is a very important moment for all of us at PayU as by combining Wibmo’s expertise in payment security and mobile payments with our strong merchant network and heritage in payments, the combined entity will be focused on delivering more secure and seamless payments experience to our customers.

Aakash Moondhra, CFO, PayU Global said, “We will partner with leading banks to enable digital banking, merchants will gain with higher conversions rates and increased sales, and consumers will have a frictionless experience in completing digital payments transactions.”

How this Acquisition Will Help Our Merchants

Helping merchants with seamless and secure transactions is our priority! A step that we take would only be successful, if it helps you (the merchants) in your digital payments. We are in the process of creating a robust online payment ecosystem that will cater to all your needs in a secure manner and help you grow your business! For merchants, this acquisition will result in:

- Higher Success Rates, More Conversions – PayU-Wibmo integration will reduce hops in a transaction from 16 to 6. Therefore, reduce the latency & increase success rates.

- Safer Transactions – As mentioned above, Wibmo is a major provider of authentication and payment security solutions. From innovative One StepTM frictionless, device-fingerprinting to authentication through downloadable apps, to behavior modeling for fraud detection, their innovative solutions help authenticate genuine transactions while keeping fraudulent ones away.

- Great Consumer Experience – With reduced hops in transaction, higher success rates and improved authentication – your consumers will have a seamless payment experience.

Conclusion

These acquisitions and investments are a testimony to the trust all of you have shown in choosing PayU as your digital payment solution. The addition of Wibmo will definitely boost our core payment gateway service. Together, we will build even more meaning relations – with merchants, customers, and financial partners. We are sure that this acquisition would prove great for Wibmo, PayU, our merchants, customers and the fintech sector!

Have a look at how our story regarding Wibmo acquisition got covered in popular media channels, newspapers and online:

Click on these links below to know more about PayU-Wibmo acquisition:

TechCrunch, CNBC India, The Economic Times, Mint, The Hindu Business Line, Business Standard The Financial Express. Finextra,VentureBeat The Paypers.

The post PayU Acquires Payment and Security Firm Wibmo for $70Mn appeared first on PayU Blog.

]]>The post Guide to Choose the Best Online Payment Solution for Your Business appeared first on PayU Blog.

]]>According to data, there are currently 147.8 million eCommerce users in India, and we can expect this number to grow to over 358 million by 2020. However, the data also reveals that around 70% of the customers abandon the shopping cart, right at the checkout phase, which leads to losses in business.

Therefore, the payment solution that you choose should have multiple features such as a variety of payment methods during checkout, an easy-to-use customer interface and high success rates, for more conversions.

Here are a few key pointers to consider when selecting an online payment solution for your business:

1. More than Just a Payment Gateway

If you are building your business, you should choose a payment solution that offers customized products and fulfil all your payment collection needs. For instance, if you have a website, there should be an option of integrating a payment gateway; if you don’t have a website, it should offer payment links for collecting payments and more.

PayUmoney offers a variety of other products that could help you in managing your payments better!

- Web Checkout – You have done enough hard work to make people come to your landing page and add items to their cart. And you would surely not want to lose them with a badly-designed or confusing checkout page. We provide a completely redirection-less checkout for website and mobile-web through PayUmoney Bolt. The payment page opens as a pop up on the website itself, and the customer never leaves your website, leading to higher success rates and increased sales.

Click here to know more about PayUmoney’s Bolt Web Checkout

- Plug n Play SDK – If you are a growing business but so not have a website, a payment gateway for your mobile app works the best for you to collect online payments. The PayUmoney SDK allows you to accept payments on your android or ios mobile applications. You can integrate SDK easily in your app with the customized pre-designed screen and start collecting your payments through multiple payment options, in minutes!

Want a SDK for your business app? Click here.

- Platform Plugins – Would it not be amazing if your website is built on an ecommerce platform? You will get an opportunity to accept payments through them! With PayUmoney Platform Plugins, you get ready-to-use payment gateways for popular ecoomerce platforms such as Shopify, Woocommerce, Magento, OpenCart and many more. And adding these plugins is as simple as ever.

Click on the image to watch a 2-minute video on how to integrate the Platform Plugins:

- Payment Links– If you want to collect payments from your customers from anywhere but do not want to get in the process of installing payment gateways, Payment Links are the best option for you. Send the PayUmoney Payment Links to your customers via Whatsapp, Email, Social Media or any other application and request for payment.

Click here if interested in accepting payments directly into your bank account via payment links.

- Excel Plugin – If you use Excel for your business extensively, you can might just use it for collecting payments too! PayUmoney Payments Plugin For MS Excel lets you accept and manage payments right from your excel sheet. With PayUmoney’s Excel plugin, you will be able to send multiple payment links at one go.

Know more about the features of and how to integrate PayUmoney Excel Plugin here.

- Payment Buttons – If you have a business with limited products and fixed prices or you are an NGO that want to receive donations through your website, payment buttons could be the ideal choice for you to collect payments. To integrate a PayUmoney Button, all you need to do is place the “Payment Button” on your website or blog by pasting a HTML code and start receiving payments in no time!

Watch this video to know How To Create PayUmoney Payment Button.

- Aggregator Solution – If you’re building a business that connects buyers and sellers, you can use the PayUmoney aggregator solution to get your sellers paid. Aggregator solution allows multiple settlements against a single authorised transaction.

2. Easy Sign-Up & Quick Onboarding

A heavy sign up and onboarding process remains a pain point for many in the online payments industry. Going through the tasks of providing all the documents in person, waiting for approvals for months and following up with payment solutions team can take a toll on your business.

While the sign up is done in 2 east steps at PayUmoney, we are glad to share that our onboarding process in 100% online and hassle-free. While you upload soft copies of all your documents from your PayUmoney dashboard, you will keep receiving emails conforming the status of your application.

Learn more about Document Checklist for Payment Gateway through this post.

3. Higher Success Rates

It is essential to check and compare the success rates of various online payment processors. Always check if the online payment solution you choose has all payment modes. Higher number of payment options, ease of checkout, lead to higher success rates.

PayUmoney is badged with the best transaction success rates in the industry so far.

4. Low Charges

Paying for every transaction is not a small cost, when you are running your own business! Therefore, you should always compare the setup fees, transaction charges and ask if there are any hidden charges from various payment solution companies. At PayUmoney, we make sure that the price we offer to the merchants for carrying out transactions are best in the industry, and legal.

There is zero setup charges or Annual Maintenance Charges (AMC).We charge 2% + GST on every transaction.

For American Express & Diners Cards, transaction fees is 3% + GST for international transactions.

5. All Payment Options

It is always better to give maximum payment mode options to your customers so that the chances of drop offs reduce. The more payment options you give, the more convenient it will be for the customer, thus impacting your conversions. PayUmoney supports various payment modes such as:

- Credit/Debit Card

- Net banking

- UPI

- EMI

- E-Wallets

- Tez

- LazyPay

6.Offers International Payments + EMI Options

To grow your business globally, you should implement a payment solution that accept payments in different currencies. PayU offers international payments acceptance to our merchants in partnership with leading banks, in 30 currencies.

Here is a step-by-step guide on how to Accept International Payments with PayUmoney.

EMI Option

There are a lot of people who find it easier to pay through EMIs (Equated Monthly Installments). PayUmoney has partnered with various banks to provide this option to your customers, while they are on the checkout page. If you want to add EMI as a payment option for your customers on the checkout page, reach out to us here.

7. Seamless Checkout Experience

Customers these days expect everything to happen in a click. If you have your checkout process optimized, you might end up getting more traffic, making more purchases. An easy-to-use checkout interface makes shopping easier for them. PayUmoney has developed many additional features to make sure that your customers do not face any difficulty while checking out, either through web or mobile.

- Saved Cards – PayUmoney gives your customers an option of saving their card details at the time of their transactions, so that they do not have to fill in the details every time.

Success rates for transactions through saved cards are 8-12% higher than other transactions.

- Nitro Feature– By integrating Nitro Flow, we save your customers from the pain of remembering and entering login credentials, every time they make an online payment. They can quickly access their Saved Cards with PayUmoney and make payments.

Our merchants have seen a growth of 6-7% in success rates, using Nitro.

- Easy Retry Option – In case your customer drops off during checkout process due to some technical or network error, he will not have to fill his details again. The customer can retry seamlessly by starting from where they had left.

- Payment Mode Intelligence – PayUMoney uses a proprietary algorithm that displays the most preferred option of payment to your consumers, thus providing a frictionless and fast checkout experience.

Read on to know more about PayUmoney Web Checkout: Completely Redirection-Less Checkout For Website and Mobile-Web

8. Highly Secure

With an increase in businesses using online payment solutions, there is also a fear of cyber fraud. You must have heard in news of hackers aiming to get card details of the customers via hacking sites. However, one of the key goals of PayUmoney is to secure general as well as financial information of its users. The following pointers make PayUmoney a totally secure payment processor:

- It is a PCI-DSS compliant, which means PayUmoney adheres to all the security standards and practices recommended by the Payments Card Industry.

- Also, there is always a two-factor authentication during checkouts. First, the customer must enter the CVV and secondly, enter the OTP sent on his registered mobile number.

9. Powerful Dashboard for Tracking

The online payment solution that you use should not only have payment accepting options but also provide you with the convenience of tracking and managing online transactions.

The PayUmoney dashboard enables you to view all your transactions in a systematic form. Also, you will be able to keep a tab on your cashflow – how much money is being credited, how much debited (refund), reconcile payments and send payment links to your customers.

Read more about various filters and features of The All New PayUmoney Dashboard

10. Optimized for All Devices

The payment/checkout page of your business must be optimized to adapt to any device such as desktop, mobile, or tablet to provide better payment experience to the customers.

PayUmoney’s checkout page is highly optimized & responsive for any device be it smartphones, tablets, desktop or laptops. Thus, your consumer experiences a seamless payment checkout, irrespective of the device or browser.

Also, PayUmoney has a Mobile Only Checkout feature that allows consumers to checkout through mobile easily. The consumer will not be required to enter his email address during checkout, if he has done that before on web checkouts.

Conclusion

Security and easy-to-use checkout pages play the most vital role while you are in the process of selecting an online payment solution for your business. And PayUmoney is the world’s leading payment solution provider, in terms of success rates and convenient checkouts.

If you’d like to have all these benefits and grow your business efficiently, sign up on PayUmoney.

The post Guide to Choose the Best Online Payment Solution for Your Business appeared first on PayU Blog.

]]>